A Beginners Guide to Crypto Derivatives

Crypto derivatives have been part of the crypto ecosystem since around 2012 and continue to be popular with speculators, hedgers, and those with a love of leverage. In this article I will cover the history of these products, similarities and differences to their traditional counterparts, and give a breakdown of how these financial products actually work.

What is a Derivative?

In its simplest terms, a financial derivative is a financial instrument whose value is derived from some other asset or group of assets. They are a form of contract between parties where the terms of the deal are agreed beforehand, and the price of the derivative is (generally) based on the behaviour of the underlying (the asset which the derivative is based on) price. These instruments can be either created with another trader one on one (called Over The Counter or OTC), or in a standardised way on an exchange. There are several types of derivatives that are actively traded, with futures, options and swaps being some of the most common.

Derivatives are useful to a variety of different market participants. For instance, they can help farmers hedge (lock in) the price of their produce, allowing them reliable cashflow in an uncertain industry. They can help speculators who believe they have an edge, and need a way to gain exposure to certain markets. They can also undoubtedly be complex, and require a good understanding of the fundamentals to effectively use.

A Short History of Crypto Derivatives

Financial derivatives have existed for thousands of years. One of the earliest known derivatives can be dated back to 600BC, where Thales of Miletus (a Greek philosopher and mathematician) supposedly exploited his knowledge of astronomy to predict a bountiful olive harvest in the next year. He used his meager savings to buy up the rights to use the olive presses one year in advance at a cheap rate. When the olive harvest was indeed bountiful, he found his rights (which were essentially a call option) were now much in demand, and commanded a high price.

A posthumous illustration of Thales of Miletus, the first ever “derivatives trader”.

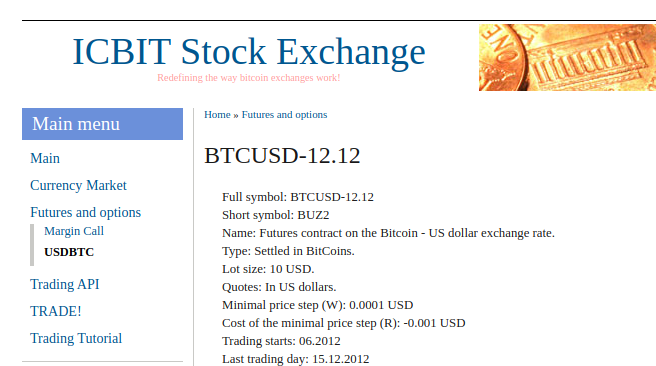

In the crypto world, we certainly don’t have to look that far back. Arguably the first crypto derivative was the BUZ2 Future listed on the Swedish ICBIT exchange. This product was listed in August 2012 and enjoyed limited but respectable volume as the main focus at the time was the spot market. About a year later Bitfinex and OKCoin (and several other exchanges) listed their own versions of the Bitcoin as well as Litecoin futures. Throughout this time volumes were a few hundred million USD per day in derivatives; however, this was still significantly lower than the spot volume.

Screenshot of the BUZ2 contract on ICBIT back in 2012, courtesy of the Wayback Machine.

In 2014, a startup called BitMEX started listing a variety of crypto derivatives. Their key innovation made its first appearance in 2016, with the introduction of the XBTUSD Perpetual Swap. Many traders found futures difficult to understand compared to spot, and the perpetual swap had the benefit of never having to settle. Combining this feature with high leverage (famously 100x), meant the volumes crept upwards gradually before taking off in 2017. To this day, the XBTUSD contract still remains one of the most popular contracts in the market.

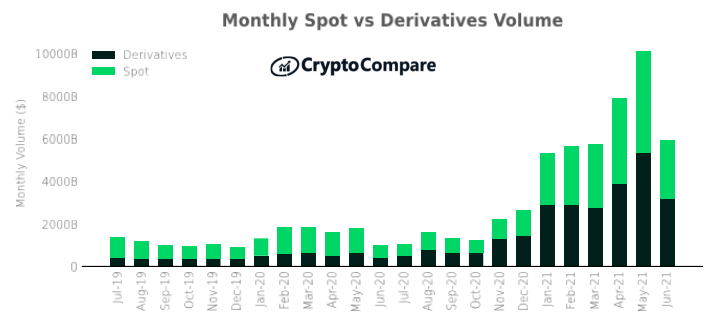

In the intervening years multiple exchanges popped up, all of which started offering derivatives. Exchanges started offering more variety of derivative products (such as Deribit offering options). Some exchanges blew up (went bankrupt) due to questionable risk management practices, or just closed down due to lack of volume and competition. In 2017 the Chicago Mercantile Exchange (CME) was the first traditional exchange to list a Bitcoin future, further increasing adoption for institutional clients. At the time of writing, there are hundreds crypto derivative products with multiple different underlying products, listed on over 50 exchanges, with the number growing at a steady pace. The total derivatives volume per day now is on the order of USD100 billion.

Chart showing monthly crypto spot vs derivatives volume. Source: Cryptocompare.

Understanding the Spot Market

A spot market is a market where financial instruments are traded immediately “on the spot”. In the crypto world, this pretty much represents all of the exchange markets where coins are traded for fiat, or for other coins.

The crypto spot market for the most part has the most in common with the currency markets (also called Forex or FX). All products listed will typically keep to the following conventions:

Currency Pair

Each instrument is called a currency pair, and is made up of two component currencies. When the pair is listed it will usually be in a form like this: BASE/QUOTE. See the BTC/USD pair from Coinbase below for an example.

An example of a BTC/USD currency pair from Coinbase

The pair represents a rate of exchange between two different currencies. The base currency is the currency that we are trying to buy or sell. The quote currency represents the cost in the quote currency to buy or sell 1 unit of the base currency. For instance, if the price of BTC/USD is $40,000 that means to buy one Bitcoin (BTC) you need to pay 40,000 USD. Likewise, if you sold 1 Bitcoin, you would receive 40,000 USD. Obviously this is just an estimate, as the actual price you would get would depend on the liquidity of the order book for that pair.

Currency Conventions

Because this is a spot market, you both receive and pay the currencies you bought/sold instantaneously. If you buy the BTC/USD pair you go long the base currency (BTC), and simultaneously go short the quote currency (USD). See the previous article on how to keep track of long and short positions. Usually you will receive these coins immediately in your exchange wallet, and can use them for any other trade you like.

You might wonder can we quote for instance “USD/BTC”? The answer is you can, but it really makes no difference as it is just a convention. This currency pair is identical to BTC/USD other than going long in one would be the same as going short the other. In foreign exchange, different countries have different conventions for FX. In the USA they prefer direct quote which is where the foreign currency is the base currency and the local currency is the quote currency e.g. AUD/USD or KRW/USD. In other countries such as the UK, the opposite indirect quote is preferred with the local currency being the base currency e.g. GBP/HKD or GBP/NZD.

A Quick Warning

Derivatives and derivatives trading is a complex subject. I know guys with entire bookshelves filled with volumes on the various nuances of this subject. This guide is meant to be an introduction to crypto derivatives, and therefore I will NOT go into excessive detail on the products themselves - there are others who have done a far better job than I will ever do (also I’m a developer, not a quant). With that in mind, I have tried to keep it as pared down as possible while still getting the point across. And as always, this is not investment or trading advice!

Futures

The first derivative we will look at is the future. A future can be viewed as a contract between two parties. The contract specifies that at a certain date (the settlement date) one of the parties will have to provide a certain asset (called the underlying) to the other party. For a futures contract, the person that went long (bought the contract) is the one that will receive the asset, while the one that went short (sold the contract) is the one that will have to provide the asset.

Futures have a variety of uses, but one of the most common (and traditional) uses is for managing price risk for a certain asset. A common example used is that of a wheat farmer wanting to fix his wheat prices, but, in the interest of brevity, we will switch it up by using a different example.

Consider a website design contractor who prefers to be paid in crypto - specifically Bitcoin. He makes a deal with a client to build them a website. It is currently April, and his deadline is in September. The client insists that he will be paid 10 Bitcoin once the work is complete in September. The contractor is worried however - he knows that Bitcoin is very volatile. The price is $40,000 now, but what if it suddenly crashes to $20,000, or $10,000! He has a mortgage to pay, and the repayments are in US Dollars. The bank, it seems, does not want to hear about magic internet money.

A September 24th 2021 BTC/USD future from FTX.

What to do? The contractor goes on a crypto derivatives exchange and looks up the listed futures. He sees that there is a BTCUSD future that settles in September available, and the current price of this future is $39,000. He sells (goes short) 10 BTC worth of the futures, and gets to work on the website. September rolls around, and the contractor is finished with the website. The client is happy, and sends him the 10BTC. The future settles, and he hands over the 10BTC and receives 10 * $39,000 = $390,000. His mortgage is secure and he can rest easy. In the interim the price might have gone up a lot (meaning he missed out on those gains) or it may have crashed massively (meaning he avoided losses). By selling the future, he managed to reduce risk or hedge his Bitcoin long position. Whatever the spot price of Bitcoin does, he does not care, as his US Dollar price is secure.

What about the other side of the trade, the counterparty who went long? They have the opposite problem to the contractor. They may have liabilities priced in Bitcoin (such as the company that hired our contractor and needs to pay him). Their business costs are mostly in USD, but they need to buy Bitcoin in order to pay their contractors and other crypto costs. They buy the future to fix the price of Bitcoin in USD so that they can be less exposed to volatility. It is both sides of the same coin.

Cash Settlement

What we just discussed is a method of settlement called physical settlement where the parties provide the actual asset that the futures contract is for at the time of settlement. This form of settlement is common in the commodities markets where e.g. there is actual wheat that is required by one of the parties. At the time of writing this is not that common in the crypto space, likely due to lack of demand and escrow complexity.

Instead, most crypto exchanges use cash settlement in order to settle futures. Cash settlement somewhat simplifies the process by not requiring any physical transfer of Bitcoin. Instead, as the contracts settles a settlement price is calculated from the underlying spot market for BTC. Each exchange does this differently, but their main aim is trying to prevent manipulation of this important price. BitMEX for instance takes a 30 minute TWAP (Time Weighted Average Price) of its Bitcoin index (an average of several different exchanges spot markets) before the settlement time as the final settlement price. This diversity and time requirement prevent individuals from trying to quickly move the price just before settlement by buying or selling large volume in the spot market.

Once the settlement price has been established, the counterparties each get cash as if the Bitcoin they were trading had a price of the settlement price. For instance, let’s say we have two participants - one long and one short a 1BTC future respectively. They originally traded and entered their positions at $40,000. The future settles at a settlement price of $35,000 since the spot market has gone down since they entered their positions. Instead of transferring a physical Bitcoin, the “cash equivalent” or $35,000 is transferred from the short participant to the long participant.

The short participant had a cost basis of -$40,000, and paid $35,000 to the long participant, leaving a final cost of -$40,000 + $35,000 = -$5,000. Because the cost is negative, this is actually a $5,000 profit. The Long position had a cost basis of $40,000 (positive cost, as they paid money for the long position), and they receive (negative cost) $35,000 from the short participant. Their final cost is $40,000 - $35,000 = $5,000. That is a $5,000 loss on the futures position. While one party gained and the other lost, it is not that different to having physically settled the contract since it works out the same as one party buying and the other party selling a Bitcoin.

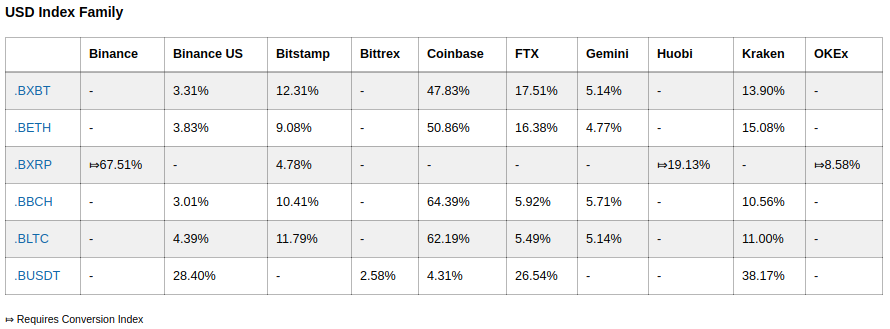

Index Price

While a future is traded, the price of the underlying spot market is important. The index price represents the spot price of the underlying (the instrument the future settles on, in this case Bitcoin). In order to not be dependent on one single spot exchange, derivative exchanges will come up with an index which is meant to represent the fair price of Bitcoin in the market. The last price (last traded price) of the coin is weighted on each of the exchanges to form a single price. Below is an example of some weightings on BitMEX for a variety of coin indices:

A snapshot of index weightings from BitMEX. The Bitcoin index .BXBT represents the index price of Bitcoin, and it is derived from 6 different spot exchanges.

Basis

You might be wondering the following: “If I buy a contract 3 months in advance, and I settle on the price of the spot market 3 months later, how do I know if I am getting a good price on my futures contract?”.

In physically settled commodities markets, the price of the futures contract takes into account several factors. Firstly, there is the cost of carry, which represents how much it costs to physically store a commodity. Wheat for instance must be stored in large grain silos, and these are expensive to maintain.

A grain silo used for storage of wheat. They can be expensive to maintain, not least because they can sometimes explode…

If it costs $0.02 per day to store 1 bushel of wheat, and the futures contract settles in 30 days, then at minimum the contract price needs to be higher than the spot price by 30 * $0.02 = $0.6. That means if the spot price of 1 bushel of wheat is $7, then the futures contract 30 days out will be at least $7.60. This compensates the short position for having to store the asset (wheat) before giving it away at settlement.

There are other factors that go into the futures price, one of which is the perception of the market by the participants. If the market believes that there will be a wheat shortage in a month’s time, that will immediately cause the futures price to increase, as traders assume that the spot price will be much higher in the future. This difference between the futures price, and the underlying spot price is called the basis. The basis is simply:

This is commonly expressed as a percentage of the spot price (percentage basis) which is calculated as follows:

Basis can be both positive or negative. The basis can in a way be viewed as a type of interest rate since the futures price represents what traders believe the price of the spot should be at settlement. If the percentage basis is 5%, that implies a belief that the spot price will be 5% higher at settlement. If it is -5%, it is expected that the spot price will be 5% lower. Because futures come with a variety of settlement dates, it can be difficult to compare them. Therefore, basis is sometimes represented as annualised basis, which is the basis but in context of how many days are left till settlement. The following formula gives this value:

Where

It is important to understand how the basis behaves as the future moves closer to settlement. We know that the future will HAVE to settle at the spot price, so logically at the time of settlement, the basis should be 0. In fact, what typically occurs is the closer you are to settlement, the smaller the basis. The chart below illustrates how a typical future behaves as the settlement date approaches. Note that as the settlement date approaches the basis reduces all the way to 0.

Chart showing a hypothetical future that settles on 24/03/2021 (European dates, deal with it).

Note that in some markets such as commodities, the basis can be the other way around i.e. Spot price - Futures price. The concept however is still the same.

Contango and Backwardation

When the futures price is above the spot price, this situation is called contango. It usually implies that there might be a cost of holding onto the asset involved, or that people assume that the spot price will be higher in the future. The opposite situation (where the futures price is below the spot price) is called backwardation. Backwardation normally implies that there might be some benefit to holding the asset, e.g. it pays you interest, or that there is higher demand for an asset right now than traders believe there will be when the future settles.

Future Conventions

In the crypto market, there are very few naming conventions, with different exchanges doing their own thing. In the traditional markets futures use month codes to indicate in which month they will settle in. The exact day of settlement is usually the third Friday of the month.

A list of Bitcoin products listed on BitMEX. Note the September 2021 (U21) and December 2021 (Z21) futures contracts.

The individual month codes are listed below:

| Month | Code |

|---|---|

| January | F |

| February | G |

| March | H |

| April | J |

| May | K |

| June | M |

| July | N |

| August | Q |

| September | U |

| October | V |

| November | X |

| December | Z |

Rolling a Future

If the settlement date for your future is approaching, you may want to keep the position going. To do this, you need to roll the future. This means closing the position on your current contracts that are about to expire (the front month), and opening the same sized position on the next contract (the back month). There is a cost associated with this, which is the price difference between the two contracts called the rollover cost.

For instance let’s say it’s the 20th of June, and you have 4 days left till the expiry and settlement of the June future which you are long 1,000 contracts. You want to keep your position going, so you decide to roll your futures. The June future (the front month) is currently trading at $40,500, and the September future (the back month) is trading at $42,000. You sell the June futures, and at the same time buy the September futures. Your rollover cost was $42,000 - $40,500 = $1,500 per contract.

Open Interest

You might have noted that with futures, every long contract must have an opposite side short contract without exceptions. This means that the amount of long contracts must equal the amount of short contracts. The open interest is a number that represents the total amount of contracts that are present in the market. So if there are 100,000 long futures contracts active, then there must also be 100,000 short futures contracts active. This also means that the open interest is 100,000.

Perpetual Swaps

In the early days of crypto derivatives, the only products that really had any volume were the futures. One of the reasons clients liked these products was that they gave access to leverage, which is the ability to acquire a position (sometimes called exposure to an asset) for a fraction of the cost of the actual position. For example, if you went long on 1BTC worth of BTC/USD futures priced at $40,000 that would normally cost you $40,000. However, derivatives exchanges easily allow you to trade on margin meaning that you only need to provide a fraction of that cost. If the leverage you are offered is 5x, that means that you only need to put up

Spot exchanges will also sometimes allow you to trade on margin; however, because you are dealing with physical cash and coins rather than derivative contracts the amount of leverage offered is normally much lower (around 2-3x vs up to 100-125x on derivative exchanges). Margin trading and leverage are beyond the scope of this article, but I plan to cover them in a subsequent one.

Early exchanges offered around ~7x leverage, which was nice, but some early crypto traders were not well versed in how futures worked. Most assumed they were just another version of the spot market, and were confused and incensed when their position suddenly “closed” because settlement came around. Rolling futures was tiresome, and many clients just wanted exposure to the Bitcoin price, but with the availability of leverage. In 2016 the BitMEX founders noted these complaints, and decided that what was desirable was to have a product that behaved like a future, but that would never settle.

One problem: If a future never settles, what keeps its price in line with the spot market? Because traders know that a future MUST settle at the spot price, there is an incentive for the basis to be reasonable, and to converge to 0. The solution to this was to create a swap.

Interest Rate Swaps

In traditional markets, swaps are usually associated with interest rate swaps. This is a form of instrument that allows you swap the interest payments of one interest rate, for the payments of another.

For example, say you are a business that has a $1,000,000 loan. Currently, you have a floating rate of LIBOR + 1%, meaning that every month you pay an interest rate of LIBOR (the London InterBank Offered Rate, an interest rate set by UK banks) plus an extra 1% on top. Every month when you pay interest to the bank, the bank will look at what LIBOR is at (e.g. 2%), and charge you 1% on top (so 1% + 2% = 3%). Because your actual rate floats with the LIBOR rate, you are very exposed to that rate. If it goes up, you might find yourself paying very large interest payments. If it goes down however, then your loan gets cheaper with the now lower interest rate.

As with most derivatives, you can use a swap to hedge this interest rate risk. You buy $1,000,000 of swaps to swap the LIBOR rate for a fixed interest rate of 2.5%. Every month, you pay the counterparty 2.5%, and the counterparty will pay you whatever the LIBOR rate is. If LIBOR is below 2.5% then you will transfer the difference to the counterparty, and if LIBOR is above 2.5% the counterparty will transfer the difference to you. At this point, no matter how high LIBOR goes, you will always end up paying 2.5% + 1% which is 3.5%. If LIBOR is low you might end up paying more than you otherwise would have, but you will never pay any more or any less than 3.5%.

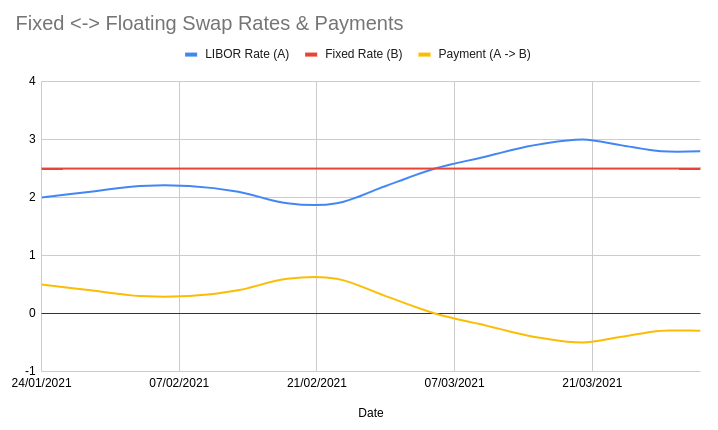

A chart showing the payments that need to be made on a LIBOR <-> Fixed swap between two clients A & B. Negative values indicate a payment in the opposite direction (B -> A)

Funding

The BitMEX founders realised that this mechanism of swapping payments at a regular intervals could plausibly be used to anchor the swap’s price to the underlying spot price. The problem that needed to be fixed was as follows:

- If the swap price is above the spot price, then the swap price needs an incentive to go down towards the spot price.

- If the swap price is below the spot price, then the swap price needs an incentive to go up towards the spot price.

- We don’t want to ever have to settle our position.

The solution was the so-called perpetual swap. A variation of this had been suggested back in 1992 by Robert Shiller however no-one had ever brought a full-fledged version of this product to the market. The swap was perpetual because it never settled or expired. Instead, the exchange kept track of the swap’s basis over time, which influenced the payments that the individual holders of the swap needed to make.

The original version of the perpetual swap was the XBTUSD swap on BitMEX. This is an inverse contract (more on this later), meaning that it uses Bitcoin as the margining currency, even though the quote currency is in USD. The swap has a funding period which is 8 hours, which is the length of time between payments between parties holding the swap. Throughout the 8 hour period the exchange calculates the so called premium index every minute, which corresponds to the basis of the swap (swap price - index price). For extra security and to protect against order book manipulation, the price of the swap is calculated using the mid price between the impact bid and impact ask. The total premium for that 8 hours comes to:

where

This premium rate represents over the last 8 hours how much the swaps price has been on average above or below the index price. There are more components that go into this such as a base and quote interest rate, and the full calculations can be found in each exchange’s documentation (here is the BitMEX perpetual guide for instance). The final value is something called the funding rate which is represented as a positive or negative percentage.

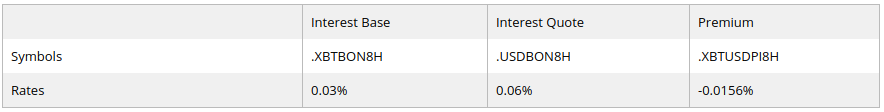

An example funding rate breakdown from BitMEX

Every 8 hours, a funding event occurs. At this time the following rules are carried out:

- If the funding rate of the previous 8 hours is POSITIVE, then long position holders pay the short position holders the mark value of their position multiplied by the absolute value of the funding rate.

- If the funding rate of the previous 8 hours is NEGATIVE, then short position holders pay the long position holders the mark value of their position multiplied by the absolute value of the funding rate.

The funding rate used is always the funding rate of the 8 hours prior to the current funding period. So for example, if right now it is 20:00UTC, the funding rate that will be paid is the funding rate derived from 04:00UTC to 12:00UTC. This is so that users will know in advance what their funding will be, so that they can make a decision on their position.

The net effect of this is that if the swap price is higher than the index price, then long position holders are encouraged to sell or even go short. That way they avoid the funding payment, or even better earn the funding payment if they go short. If the funding rate is negative, then the opposite applies.

Swap price vs Index price chart. Note what the incentives are when the basis is positive or negative.

Due to this mechanism, the price of the swap usually stays quite close to the index. In a way it can be viewed as a continuously rolling 8 hour future which is cash settled. Swaps allow high leverage (famously 100x) directional trades with minimum upfront capital, and reduced complexity in terms of settlement. These products (sometimes called “perps") have proven to be very popular, and many other platforms have since adopted them as well.

Options

If a future is the obligation to handover an asset at settlement, an option is a similar instrument but where you are not necessarily obligated to settle. Over-eager traders on Wall Street Bets may have given options a bit of a bad name of late, but they are a valuable tool for both hedgers and speculators.

An option has a few components:

- Put or Call

- An option is either a Put or a Call option. A call option gives the buyer the OPTION of buying an asset from the counterparty a certain price. A put option gives the buyer the OPTION of selling an asset at a certain price. Taking this action is called exercising the option.

- Underlying

- Just like in a future, the underlying is the asset that the option gives the buyer the option to buy or sell.

- Expiration Date

- After the expiration date is reached, the buyer no longer has the option to buy or sell the asset. This can be viewed as the lifetime of the option.

- Strike Price

- The price at which a buyer of the call option can buy the asset at, or the buyer of a put option can sell the asset at.

- Premium

- The price of the option.

Options also come in a variety of flavours, with the below being the most common:

- American Options

- Option can be exercised at any time prior to the expiration date.

- European Options

- Option can be exercised only on the expiration date.

- Bermudan Options

- The option can only be exercised on a specific set of dates prior to the expiration date. A sort of middle ground between American and European style options.

Buying Options

Options can be viewed as a form of insurance on a position. Let’s say a trader has a long Bitcoin position, they may be worried about the Bitcoin price falling and leaving them unable to fund their Lambo repayments. Let’s say they own 100 Bitcoin, and at the current price of $40,000 their position is worth around $4,000,000 in dollar terms. They see that there is a Put option with a size of 1BTC, a strike price of $40,000 and an expiry that is 30 days out. This option costs (has a premium of) $1,000.

The trader decides to buy 100 option contracts to cover their whole position. The total cost was $100,000. If the price of Bitcoin stays above $40,000 then the option is not worth exercising (to trigger the clause that allows them to sell their Bitcoin at $40,000) as they could just sell at a higher price on the spot market. This is called being out of the money. If the price falls below $40,000 their put options become in the money, as they are selling at a price above the spot price.

Bear in mind however that they paid $1,000 for each option, so actually it only makes sense to exercise below $39,000. By buying the put options they have managed to insure their $4M position (at a cost of $100k) so that if the price falls below $39k, they can exercise their option and not lose more than the 1k. As opposed to futures however, they are not on the hook if the price of Bitcoin goes up.

Diagrams showing the payoff profile for buying Call and Put options.

Selling Options

Selling an option is also sometimes called writing an option. As opposed to buying an option (where only the premium you paid is at risk), selling an option can have a significant amount of risk attached if you don’t know what you are doing. The issue here is that because the buyer can exercise their option you must be in a position to either sell or buy the asset as specified in the option. Therefore, if you sell a call option on Bitcoin, and then the counterparty exercises that option, you now need to be able to sell them Bitcoin at the strike price. If you do not have the Bitcoin, you are essentially in breach of contract. In traditional finance you might get sued, or your positions liquidated by your broker. In crypto this isn’t always possible, which is why options are a somewhat rarer instrument.

In order to sell options safely, it is required to have the assets or funds on hand to cover the eventuality of your option being exercised. For instance, you can sell covered calls by owning the underlying (e.g. Bitcoin) and selling a call option on that Bitcoin. If the options you write expire worthless, you will have made the premium. However if the price moves against you, you will always be able to sell your Bitcoin to the counterparty. Not having your call covered can expose you to theoretically infinite losses.

Diagrams showing the payoff profile for selling Call and Put options.

Options Pricing

The topic of pricing options is a fairly complex one, and is beyond the scope of this article. To summarise it simply: Options are priced based on the probability of them ending up profitable (in the money) or unprofitable (out of the money). The higher the probability of the option ending up profitable, the higher the premium that should be charged on it.

To do this you need to look at how volatile the underlying is (how much it moves up and down), and how close the spot price is to the strike price, and how long you have left before the option expires. The more volatile the underlying, the more likely it is that the buyer might end up being profitable. If you are close to the strike price, or are already in the money then the more likely it is that you will be profitable. Finally, the further away the expiration date, the more time you have for the spot price to move your way.

All of these factors go into models (such as the famous Black Scholes Model) that calculate what the premium should be for an option. This is where the so called greeks e.g.

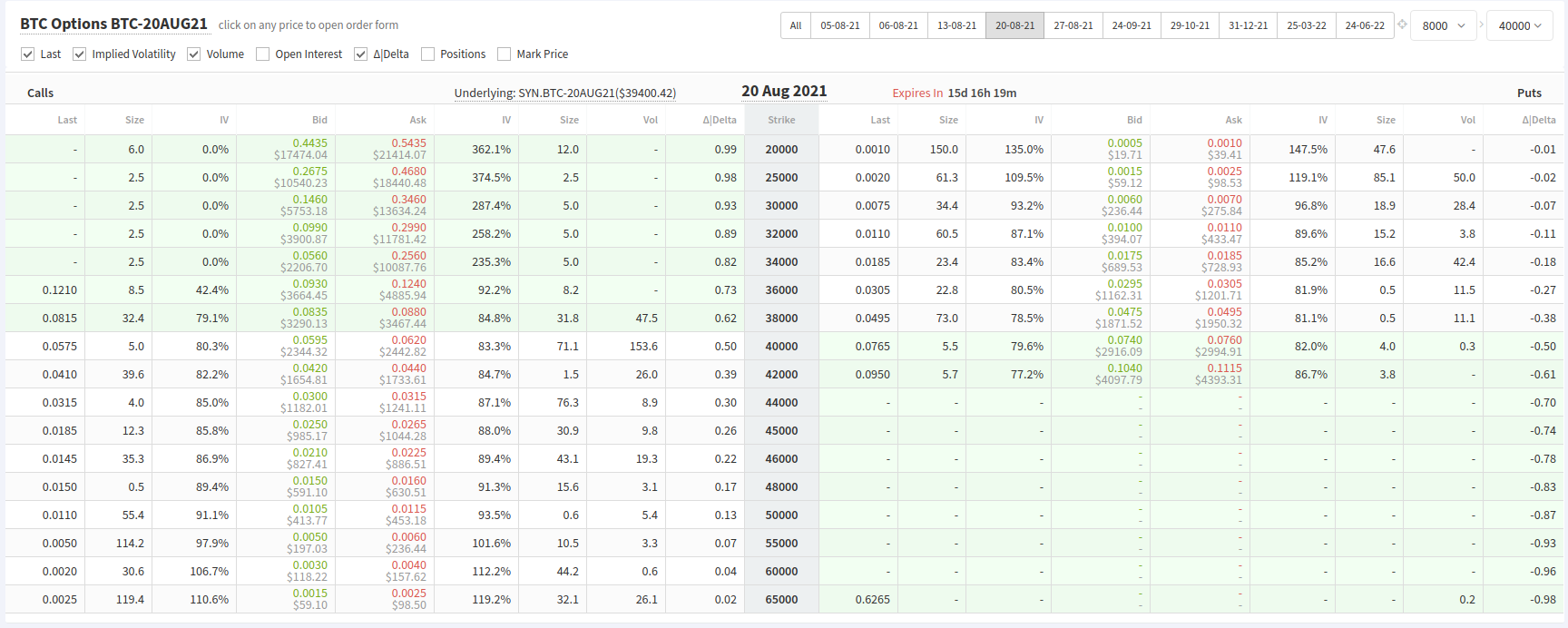

Options chain from Deribit for Bitcoin options expiring on the 20th of August 2021.

I do suggest that anyone who has an interest in it check out the intro article from Investopedia as a start.

Valuation Types

By now we are familiar with derivatives that have a quote currency and a base currency. In the early crypto days however, often exchanges did not have the ability to receive fiat currency. This led to a variety of different valuation types for derivatives, since it was not always possible to have e.g. USD.

Linear Contracts

A linear contract is what most people are familiar with when it comes to derivatives. A linear contract has a linear payoff because the currency that is used to pay for the derivative is the same as the quote currency. For instance, for a BTCUSD linear future, the margin currency (the currency you use to pay for the contract) and the quote currency are both USD. Therefore, the value of a position of size

For example, 10BTC worth of contracts of BTCUSD priced at $40,000 has a value of $400,000.

Inverse Contracts

In the early days of crypto derivatives, it was often difficult to get access to fiat currency. To do this required a banking relationship, or PayPal or some other money service. Even today, some of these services are hesitant to be used for crypto payments, and back then it was even worse. As a solution to this, the early derivatives exchanges would only accept Bitcoin deposits since all these required was a working Bitcoin wallet.

This does create a problem, however. If you have a derivative (such as e.g. the XBTUSD perpetual swap), how do you pay for it if you don’t have USD? The solution was to use inverse valuation so that Bitcoin could be used as a margin currency for this contract instead of USD. Each contract of XBTUSD is worth $1. In Bitcoin terms, how much is

So for a position of 1000 XBTUSD contracts priced at $40,000, the cost is

Interestingly, this works out the same (in Bitcoin terms) as if you had used a linear contract. Consider this: We bought $1,000 of bitcoin at $40,000, so that means for the linear contract we would have bought 0.025BTC. When the price hit $50,000 we would have then sold the position for 0.025 * $50,000 = $1,250. Our profit is $250, and at the current Bitcoin price of $50,000, that money is worth

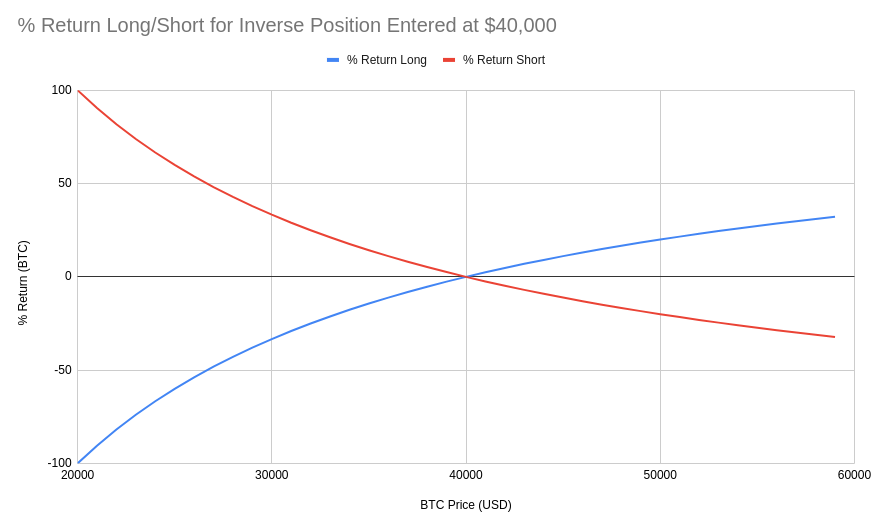

This payout structure can be somewhat confusing. In USD terms, 100 contracts of XBTUSD is always worth $100 at any price, but in BTC terms it is non-linear. The chart below shows the the Profit and Loss (in BTC) if you entered an inverse XBTUSD position at $40,000.

Chart showing the profit and loss (in BTC) for an inverse contract position entered at $40,000

Notice that once the dollar price of Bitcoin halves, your inverse contract has now lost 100% of the initial value. This means that by going long on an inverse contract you can lose all of your equity even if you did not use leverage. In general going long on an inverse contract has limited upside, with amplified downside. A short contract is the opposite with amplified upside, but limited downside.

Quanto Contracts

The inverse contract managed to solve the problem USD quoted Bitcoin products. What wasn’t solved however was how to offer derivatives on non-Bitcoin products. If you were not willing to take payment in Ethereum or USD, how could you offer e.g. an ETHUSD perpetual swap product?

The solution ended up being the use of quanto or quantity adjusting contracts. This is a contract where the contract is settled in a currency that is neither the base currency (e.g. ETH) or the quote currency (e.g. USD), but a third currency (the settlement currency, e.g. BTC). This requires that there be a fixed exchange rate between the quote currency and the settlement currency, which is also called the multiplier.

Take an example quanto contract ETHUSD which is settled in Bitcoin (BTC). The Bitcoin value of this contract is

where

What this essentially implies is that the contract is linear in Bitcoin terms in respect to the price of the contract. The multiplier fixes the exchange rate between BTC and USD. The value in terms of USD however is also linear in terms of the Bitcoin index price:

where

In statistics correlation is how closely two variables move together. When two values move closely together positively the correlation will move towards 1. If two values move the same but in opposite directions then the correlation will move towards -1. If they don’t move together in any way, the correlation will be around 0.

Example of correlation of points on an X,Y axis from Wikipedia

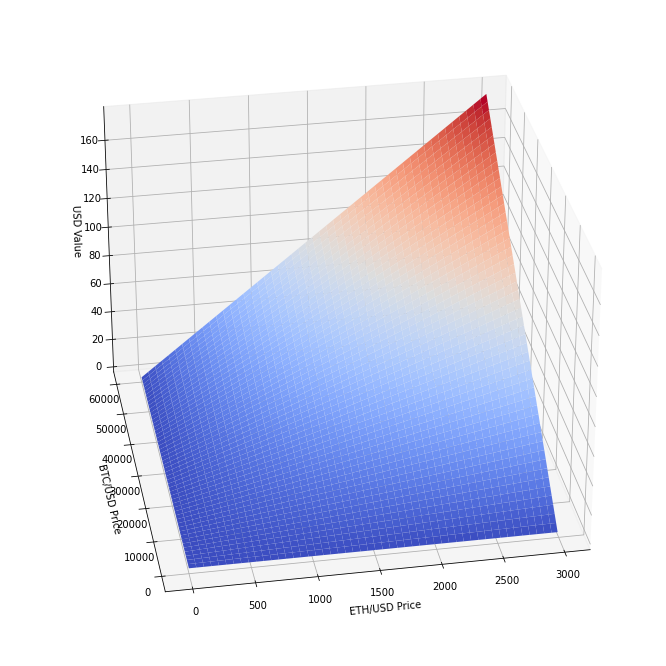

If we assume the ETHUSD price is more or less the ETH index price (due to the funding tethering), and we do a 3D plot of the USD value of a contract compared to both the ETH and the BTC index, we get the following:

Chart showing the USD value of an ETHUSD quanto contract (multiplier = 0.000001) compared to the ETH/USD and BTC/USD prices

In general, the following applies depending on the correlation:

- BTC moves with ETH (high positive correlation)

- USD value moves in non-linear fashion (approximately

- BTC moves with opposite to ETH (high negative correlation)

- Given that the BTC price moves opposite to ETH, we expect our USD value to remain somewhat flat

At the time of writing the correlation between ETH and BTC is sitting around 0.8, implying a somewhat high degree of correlation. For a much more detailed description of how Quantos work, I suggest this article from BitMEX, and this analysis from Deribit.

Edit Apr 2023: Cleaned up links

Glossary

- Annualised Basis

- A measure of basis as if it was a yearly interest rate.

- Back Month

- A futures contract which has an expiration date later than the front month.

- Backwardation

- Where the futures price is lower than the spot price.

- Base Currency

- The left currency in a currency pair (e.g. BTC in BTC/USD).

- Basis

- The difference between the futures price and spot price.

- Blow Up (Exchange)

- When an exchange goes bankrupt. Usually this is in the context of not managing the risk of margin trading and large positions by users.

- Call Option

- An option to buy an asset at a predetermined strike price.

- Cash Settlement

- Opposite of physical settlement. Instead of transferring the underlying asset on settlement, the cash equivalent is transferred instead as determined by a settlement price.

- Contango

- When the futures price is higher than the spot price.

- Correlation

- A measure of how two values (e.g. prices of two assets) move together.

- Cost Of Carry

- A cost associated with having to store or hold an asset. E.g. Cost of storing grain in a silo.

- Counterparty

- The opposite participant in a derivatives contract.

- Covered Call

- Selling a call option while holding the underlying asset. Reduces risk of not being able to deliver the underlying asset if the call option is exercised.

- Currency Pair

- The way currencies are quoted in the FX market. Has both a base currency and quote currency e.g. (GBP/USD).

- Direct Quote

- An FX currency pair convention where the countries domestic currency is the quote currency.

- Exercise (an Option)

- To buy the underlying at the strike price for a call option, or to sell the underlying at the strike price for a put option.

- Exposure (to Something)

- To have a long or short position that will change in value when something else changes.

- Fixed Exchange Rate

- An exchange rate that doesn’t change. Used in quantos as the multiplier.

- Floating Interest Rate

- An interest rate that can change over time. Has an underlying variable interest rate (e.g. LIBOR).

- Forex (FX)

- A general term for the market for exchanging currencies.

- Front Month

- The closest expiration date for a future.

- Funding

- A mechanism used by Perpetual Swaps to periodically transfer cash between longs and shorts to keep the swap price tied to the underlying index.

- Funding Period

- How often funding is exchanged for a perpetual swap.

- Funding Rate

- The amount of funding to be transferred between longs and shorts for perpetual swaps. The sign of the rate indicates the direction of the transfer.

- Future

- A derivative contract where the buyer has the obligation to buy an underlying asset from the counterparty at the settlement date.

- Greeks

- A series of variables that describe an option.

- Hedge

- To reduce risk to a certain event or price. For instance, using a future to hedge against the underlying price.

- In The Money

- When exercising an option would make a profit.

- Index

- A general term for a price that is a composite of several other prices. E.g. the average price of BTC amongst several spot exchanges.

- Indirect Quote

- An FX currency pair convention where the countries domestic currency is the base currency.

- Interest Rate Risk

- A risk that you may lose money or have to pay more money if an interest rate changes.

- Interest Rate Swap

- A derivative that allows you to swap the payments of one interest rate for another.

- Inverse Valuation

- A valuation method common in crypto where the value of the contract is inverse to the quote currency price.

- Last Price

- The last traded price of an instrument.

- Leverage

- A multiplier that represents the size of a margin loan provided for a position. E.g. 5x means an 80% loan was provided for the position.

- LIBOR

- The London Interbank Offered Rate. An interest rate that is commonly used as a benchmark for loans, and other products.

- Linear Contract

- A contract whose value changes linearly with the quote currency.

- Margin Currency

- The currency in which the margin for a derivative is paid.

- Month Code

- A convention used for futures that states in which month a future expires.

- Multiplier

- For quantos, a fixed exchange rate from the quote currency to the margin/settlement currency.

- Open Interest

- The amount of active contracts in the market for a derivative.

- Option

- The right, but not obligation to buy or sell an underlying asset at the strike price.

- Options Chain

- A way of listing/visualising all available options contracts for an asset.

- Out Of The Money

- When exercising an option would make a loss.

- Over The Counter (OTC)

- A contract between two counterparties that is not done via an exchange.

- Percentage Basis

- The basis represented as a percentage of the underlying index price.

- Perpetual Swap

- A derivative that is quite common in crypto where a funding payment is periodically exchanged between longs or shorts to tether the swap’s price to the underlying index.

- Perp

- See perpetual swap.

- Physical Settlement

- Where settlement of e.g. a future occurs by physically hanging over the underlying asset rather than cash.

- Premium

- See basis.

- Premium Index

- An index that measures the basis over a set period for a swap.

- Put Option

- An option to sell an asset at a predetermined strike price.

- Quant

- A professional well versed in financial mathematics.

- Quanto

- A special valuation method where the margin/settlement currency is neither the base or quote currency.

- Quote Currency

- The right currency in a currency pair (e.g. USD in BTC/USD).

- Reduce Risk

- To reduce the chance of losing money due to some event or other price.

- Roll (a Future)

- To switch your position in one future which is about to expire, into another future that expires later.

- Rollover Cost

- The cost to roll a futures position.

- Settlement Currency

- The currency in which payment in a cash settled instrument will be paid.

- Settlement Date

- The date at which a future settles.

- Settlement Price

- The price at which a cash settled future values the underlying.

- Speculator

- A participant that wants to make a directional bet (long or short) on some asset.

- Trade On Margin

- To make trades using a margin loan from e.g. a broker.

- TWAP

- Time Weighted Average Price. The average price of an asset over a certain period of time, where individual prices are weighted by how long they are prevailing in time.

- Underlying

- The asset which must be bought/sold/delivered for a derivative.

- Volatility

- A measure of how much a price moves up and down.

- Write (an Option)

- To sell a call or put option.